The Hindenburg Report on Adani Group

Editor : Rishi | 04 February, 2025

Hindenberg Research on Adani Group

Source or Copyright Disclaimer

In January 2023, Hindenburg Research, a US-based financial research firm, released a damning report on the Adani Group, accusing it of stock manipulation, accounting fraud, and corporate malpractices. The report triggered a massive market sell-off, wiping out billions of dollars in market value from the conglomerate and raising questions about the corporate governance of one of India's most powerful business empires. This report delves into the reasons why Hindenburg targeted the Adani Group and its broader implications.

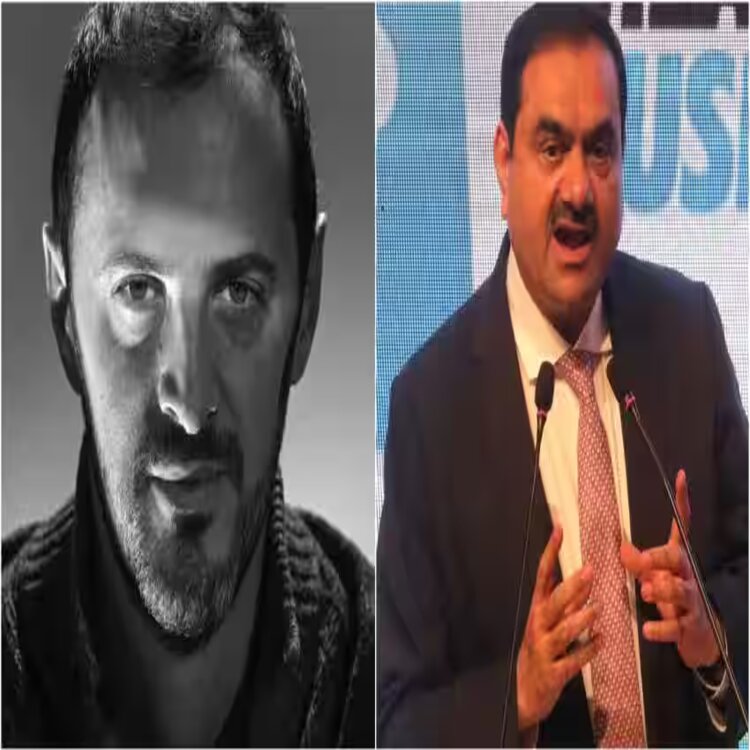

Hindenburg Research is a forensic financial research firm known for short-selling stocks of companies it believes to be engaged in fraud or unethical business practices. Founded by Nathan Anderson, the firm investigates companies using publicly available data, whistleblower accounts, and other investigative techniques. It has previously targeted several firms across different industries, exposing financial irregularities.

- Alleged Financial Irregularities: Hindenburg’s report accused the Adani Group of manipulating its stock prices through offshore shell companies controlled by close associates of the Adani family. The report alleged that the group engaged in artificially inflating its share prices to attract further investment and increase market capitalization.

- Corporate Governance Concerns: The report highlighted alleged corporate governance failures within the Adani Group, suggesting that key figures in the organization engaged in insider trading and opaque financial dealings. The firm argued that Adani’s business empire was operating with little oversight from regulators.

- Debt and Overleveraging: According to the report, the Adani Group was heavily overleveraged, relying extensively on debt to fund its aggressive expansion. Hindenburg claimed that this excessive borrowing posed a significant risk to both investors and financial institutions exposed to the conglomerate.

- Short-Selling Opportunity: Hindenburg is a short-selling firm that profits when the value of a targeted company’s stock declines. The release of the report led to a significant drop in Adani stocks, allowing the firm to benefit financially from the ensuing market chaos.

- Exposure of Indian Market Weaknesses: Hindenburg’s report also sought to highlight the weaknesses in India’s regulatory framework. It questioned the role of Indian regulatory bodies in preventing financial malpractices and ensuring corporate transparency.

The fallout from the Hindenburg report was immediate and severe. Adani Group’s market capitalization plunged by over $100 billion in a matter of days, raising concerns among global investors. The conglomerate was forced to cancel a $2.5 billion follow-on public offering (FPO) of shares due to plummeting investor confidence.

Additionally, the controversy spurred increased scrutiny from regulatory authorities, including the Securities and Exchange Board of India (SEBI) and the Supreme Court of India, which ordered a probe into the allegations.

Hindenburg Research’s decision to go after the Adani Group was driven by financial interests, investigative findings, and broader concerns about corporate governance in India. While the report led to significant financial turmoil, it also underscored the need for greater transparency and stronger regulatory oversight in Indian markets. The long-term implications of this controversy continue to shape investor sentiment and corporate accountability in India.